Barnes and Noble has disclosed that this summer they saw a decline in book sales by 3%. The bookseller saw an increase in sales from adult hardcovers and saw a modest improvement on trade paper, kids, and young adult categories. Non-books increased 1.9%, led by toys and games growth, cafe and better gift results. Overall, B&N consolidated sales decreased $20 million or 2.5% to $771 million.

I am honestly surprised the company lost money on book sales, considering there have been a myriad of bestsellers released this year. Fear: Trump in the White House by Washington Post reporter Bob Woodward, sold more than one copy per second on its release day, Barnes and Noble said. Other big sellers included former FBI Director James Comey’s memoir, “A Higher Loyalty,” and the hotly debated tell-all “Fire and Fury” by Michael Wolff.

One of the ways B&N did not lose more money this summer was because of their continued efforts to cut costs. The company reduced expenses by 10% or $26 million during the quarter. These savings were primarily achieved through lower store payroll and to a lesser extent NOOK rationalization and indirect procurement.

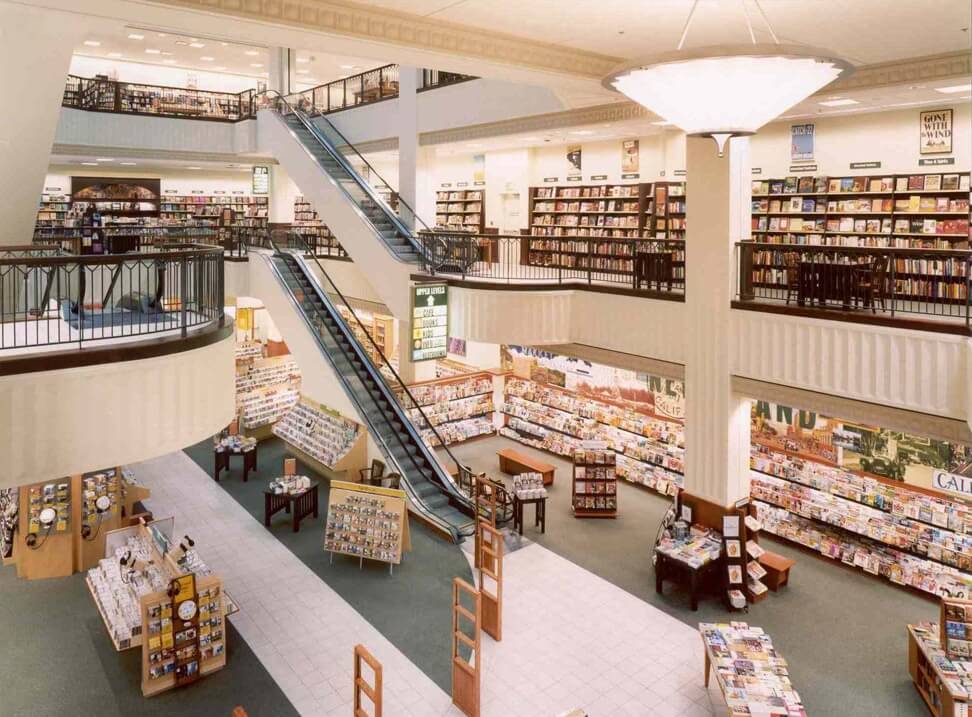

Basically, what B&N has done with the Nook division is to streamline their suppliers from many to just a few. The Nook e-readers are now designed and manufactured solely by Netronix and the Nook Tablet 7 and Nook Tablet 10 are designed and manufactured by the same Chinese company. The Nook section was moved from the front of the store, to the back, where the customer service section is. This was done to put a greater emphasis on hardcovers and popular books, which is obviously paying off.

Barnes and Noble stated that Nook sales dropped 15.8% over the summer and generated $21.8 million and the Nook group posted EBITDA of $1.1 million, up from $161,000 a year ago. They did not disclose any future plans to turnaround the division or what they would do to counter Kobo e-readers being sold at Walmart. This was evident during their earnings call and official press release. My sense is that the division is no longer a priority and is in a holding pattern.

Since Barnes and Noble is having trouble selling books and making their concept stores work, they are exploring selling the company. Barnes and Noble formed a committee last month to market the company to multiple interested parties. Leonard Riggio the largest shareholder and founder of the company has committed to support and vote his shares in favor of any transaction recommended by the Special Committee. They hired Evercore as its financial advisor and Baker Botts L.L.P. as it’s legal advisor, Evercore was the company that facilitated the Amazon and Whole Foods deal.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.