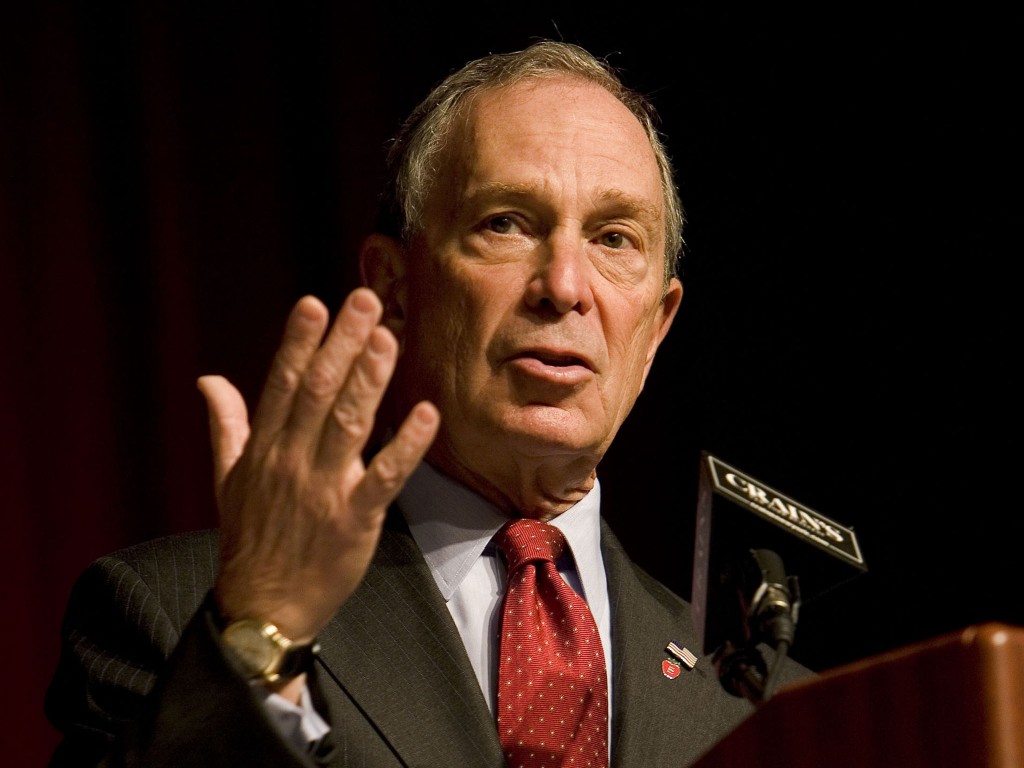

Michael Bloomberg is a man on the mission. One of his lifelong goals is purchasing one of the most influential newspapers in the world, the New York Times. A few years ago he formally approached Chairman Arthur Sulzberger about a possible deal, but was told “The New York Times will never be for sale.” Recently the New York Magazine published a speculation piece and for all sense and purposes, Michael’s interest has not waned.

Michael Bloomberg is the former mayor of New York and held the office for three terms. He is considered to be the wealthiest person in New York, whose reported net worth is north of $33 billion, could certainly afford to acquire a publicly traded media company with a market capitalization of a mere $2 billion—even if he had to pay a substantial premium.

Many of the most popular newspapers in the US also proclaimed that they would never be for sale, but look how it all panned out. The Wall Street Journal was not for sale until Rupert Murdoch made an offer that was 67% above their shares’ trading value. The Washington Post wasn’t on the market until Amazon CEO Jeff Bezos came knocking and bought it in August 2013.

The New York Times has been under the gun lately to produce. In October they reported a loss of $9 million compared to a profit of $12.9 million in the third quarter of 2013. The loss was driven, in part, by the cost of buyouts and over 100 layoffs, as well as a capital investment in new products. The company bet big on NYT Opinion, a mobile app dedicated to opinionated content and NYT Now, which was aimed at younger readers. Both had not gained the traction the Times had wanted and were quickly shuttered.

One ally that Bloomberg has in a possible buyout situation is Mexican billionaire Carlos Slim, who also expressed an interest in purchasing the Times. Last week, Mr. Slim exercised warrants to become the largest shareholder of the company with a 17% stake and told Reuters last July that his holdings in the company are a “financial investment.” If Bloomberg paid a dramatic above average rate for the company, Slim would make a copious amount of money.

Will the Times sell? It looks highly unlikely, primarily due to the way the company is structured. Poynter outlined the current situation by saying “The structure of the family trust is the heart of the matter . It would be almost impossible unless there was unanimity” among family shareholders to sell the company to an outsider. Even were there a block of dissident family members, stock in the Trust would have to be offered first to the other Class B Trust shareholders before it could go to anyone else.”

The New York Times core business is sound. Their online digital strategy is paying off big time. They basically pioneered the paywall system, that gives people a limited amount of content they can read, before they have to take out a subscription. Over 900,000 people are currently paying for this and via their official line of apps for Android and iOS apps. Third party companies are also lending the assist in generation additional revenue. PressReader is marketing the NYT replica edition to a ravenous audience.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.