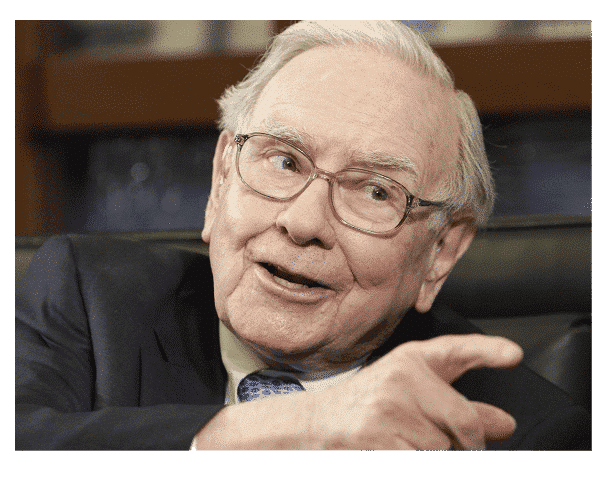

There is no end of books about investment that can be purchased for an e-reader. Some, of course, are pulpy pop psychology trash; the “I can make you rich in 30 days” type of books. Others are intriguing insights into the mind of successful investors, such as Warren Buffett. Some books can be specific and technical, such as the raft of new books about investing in and understanding blockchain and cryptocurrencies.

We can, of course, learn a lot from these books, even if they are not entirely guaranteed to make the reader a profit. Reading something about Buffet, for example, can help you get into a mindset of the successful investor, teaching you about strategy and discipline. Knowledge of one’s subject – any knowledge – was traditionally seen as a prerequisite for investment, unless someone else is doing it for you.

However, the world of individual investment has been transformed, and it has perhaps made the idea of self-help investment guides obsolete. Perhaps, they can still help in some ways, and reading them will not likely hurt your strategy, although, as you will see below, it can have a negative impact. Yet, by and large, the investing landscape has changed so much that you don’t need to become an expert to succeed.

Fintech has changed knowledge requirements

We are, of course, talking about fintech and the use of data. Today, online investment is open to everyone, and by everyone we mean that it is a level playing field for expert and novice traders, big and small investors. The era we are entering is one where data and technology can trump the sharpest human minds when it comes to investment, and it’s changing the face of the financial industry.

Let’s suppose you joined a social trading platform, and that you had no prior experience of investing and never read any books on the subject. The assumption for those that aren’t fully aware of fintech is that you would flounder, almost relying on blind chance to lead you to success. But online trading has been transformed and offers data solutions that can help traders.

Knowledge sharing is power in investment

For example, you can simply copy the trades of experts on your social trading platform, something which is actually encouraged. This type of expertise sharing has proven to be revolutionary and has been cited as an example of digital disruption, something that has traditional wealth managers wondering if their jobs will one day too become obsolete.

There is also the fact that we have data and advice at our fingertips. One could, at no cost and little effort, find out through a Google search if the price of gold is likely to rise, if the US Dollar is likely to strengthen against the Euro, if Apple stocks are set for a good year and so on. Advice and analysis is as detailed as you want it to be, and this will be compartmentalized and tailored on your social trading platform.

Going back to the usefulness of trading books, there is another problem – the shelf life of the information in them. That’s not meant to offend any bibliophiles out there, but it’s simply a reality of the fast-paced world of technology out there. Consider if you bought a book on investing in Bitcoin in late 2018, a time when sentiment on the digital coin was at its lowest ebb. Around half a year later, Bitcoin is in fashion again, partly thanks to the announcement of Facebook’s digital currency, Libra.

In the end, investment books will never be truly obsolete, but the world of investing is changing so quickly that truisms can also change overnight. The danger is that you read a book on investment and it leads you down the wrong path. You should be careful, while at the same respect the fact that it will be the sharing of data that will dominate investment strategy in the future.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.