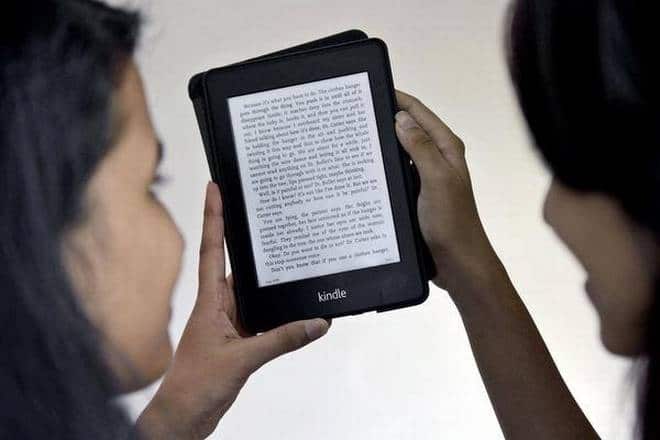

India has just lowered the tax on ebooks from 18% to 5%, but it has a few caveats. In order to qualify for the discount the ebook also has to have a print edition, which means the vast majority of self-published titles will not see a reduced tax rate.

It is currently unknown if selling one single print edition and driving more ebook sales will quality for the 5% tax. Publishers are equally confused about the entire situation. Hachette India managing director Thomas Abraham said, “The whole thing is a bit absurd. It would have made more sense if the rather draconian 12% new GST levied on royalties had been abolished, and the 12% GST on printing material was reduced, back to 5%. Both have come as a double whammy that have raised costs for publishers with no respite, as input tax credit is also not available for books, because books are GST-exempt.”

Penguin Random House India COO Sanjiv Gupta said, “In India, typically the cost of an ebook is the same as the print book. It’s a welcome step but [the GST council] should reduce the tax on printing of books. We had VAT earlier and that was 4% to 5% and some printers were charging it and others were not.”

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.