Lending businesses if finally leveraging the potential of technology to revamp hitherto sluggish processes. With the help of robotic process automation, e-readers, and natural language processing, digital lending is scaling new heights.

Using e-Reader as a digital tool in LOS

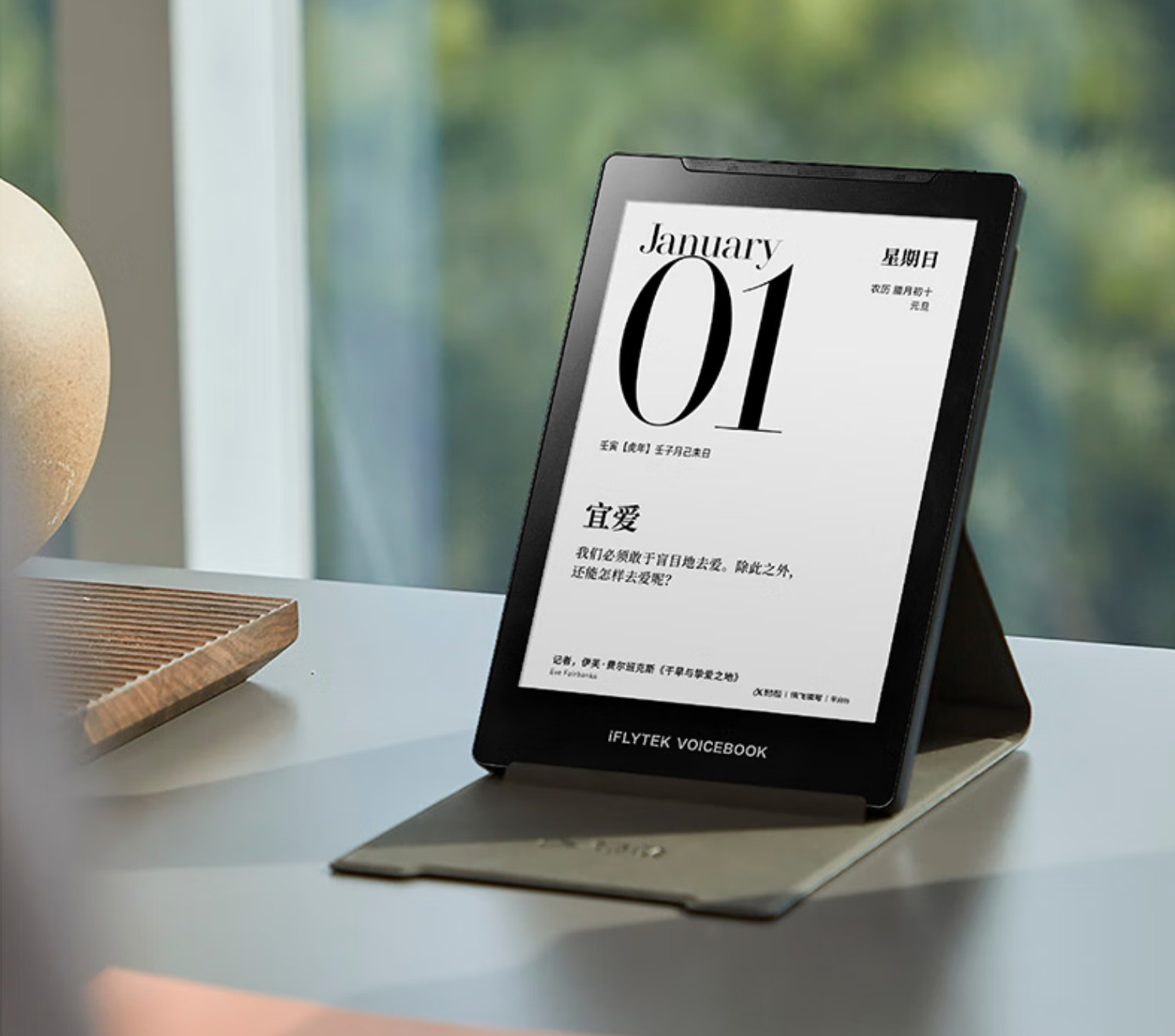

Digital lending tools of loan origination solutions are customized, as per the operational requirement of the lending business of the organization. A digital lending platform can be feature-rich that covers the end-to-end cycle of loan origination from customer onboarding to the payment of the last installment of the loan. One such feature that is catching on with LOS software is e-Readers.

With major players like Google and Amazon coming with text-to-speech software that can read the entire written text, the processing of applications can be automated and read out to the processing staff during any cycle. With the use of e-reader tasks like copying and schlepping can be transferred to the text-to-speech mode. This step cuts down the time taken and removes any anomalies in the processing stage.

LOS is not just a buzzword

A loan origination solution may be the same as a trending topic in the lending business market. However, it is not just a buzzword that is a flash-in-the-pan success with limited memory. LOS is changing the lending landscape by removing all the bottlenecks that were part of a slow loan origination process in traditional banking.

A LOS aids in seamlessly streamlining the paperwork by automating repetitive tasks and thereby reducing time and errors in a loan cycle. Right from onboarding the interested customer with robotic-assisted service and prompts in filling out the personal information, and submitting the required documents to credit assessment through third-party cross-verification by way of APIs, every stage is automated.

The scope of error is reduced in the initial stages itself. For instance, if a prospective borrower enters the wrong address, it will verify with the personal information ID and other paperwork and prompt them to submit the right details.

Consumers prefer automated lending

Business sensitivity is at the highest level in the last couple of quarters with an entire world accepting the unthinkable as the next normal. Before the pandemic, the takers for the digital world were less than thirty percent in any area of business. Banks earlier were pushing the decision to implement tech upgrades for many years.

However, Covid changed everything, and people started respecting the ability to conduct their work or any process virtually. Whatever gaps existed in the execution of the process, were removed with the use of AI and Ml aided features.

A digital LOS thus is not just a solution that banks are looking to adopt but an option that was catered to meet the demands of consumer insights.

Benefits of LOS

Lending is one business vertical that embraced sluggish and old-fashioned processes way too long. The comfort that the strict draconian lending regulatory framework offered need never impede business growth if only there was a system that could speed up the loan origination process. However, this was never the comfort that was offered by past workflow process management for lending. But with the advent of automation, digital lending is changing the way lending business was conducted in the past.

Numerous benefits are offered by a lending origination solution that will bolster any bank’s loan business growth. Here are some of the important advantages of implementing an automated lending solution:

- Simple onboarding

Client acquisitions for lending business may not have been a problem in the past as there were fewer lenders and more borrowers in the market. But with the advent of parallel lending such as Fintech and P2P lending, banks cannot remain as the top contender of desired lenders unless they make the loan application process simple at the client onboarding stage.

With automated LOS, the loan application is accessible through multiple channels and available round the clock. An applicant need not personally walk in to apply. The entire process is finished, and information is loaded online.

- Credit assessment

The most crucial stage of a loan application is analyzing the application after verifying the details and other key factors that are crucial for the loan. The risk assessment of possible loss of income and repayment ability is factored in during the underwriting stage of the loan application. With automation, credit assessment and decision stages that earlier took weeks to complete are finished within a matter of a few working hours. Loans are sometimes approved within a single business day after clearing all the checks of a loan application.

- Monitoring for quality

Loans post-approval need to be monitored for any hiccups. Consistent monitoring of borrowers’ financial health, automated alerts to pay the installment on time, and upgrading the requirement of the covenant if necessary are a part of regulatory requirements. All these features can be customized by following a rule book set for different loan products.

- Value-added services

By automating a loan origination process a banker’s role evolves, and they can spend quality time addressing core issues that need a human presence for their clients. For instance, small business owners value services like bookkeeping and tax compliance. A banker can assist small business borrowers with these services for a small fee. The additional benefit of a healthy book will help the business grow, and their expansion needs can be refinanced through the bank, thereby building long-term relationships in the future.

Conclusion:

Consumer insights point towards their preferences. When competitor services are vying for the attention of borrowers, and they are pampered with numerous choices, then banks will feel the need to upgrade their legacy lending cycles with automated digital lending systems.

Lending is the lifeline of trade and commerce around the globe, and any single bottleneck sets up the domino effect in a financial system. Therefore for staying relevant for the borrowers and at the same time comply with stringent regulatory rules for the lending business, banks must set up a loan origination solution that can meet the requirements of the entire loan cycle.

Markus lives in San Francisco, California and is the video game and audio expert on Good e-Reader! He has a huge interest in new e-readers and tablets, and gaming.