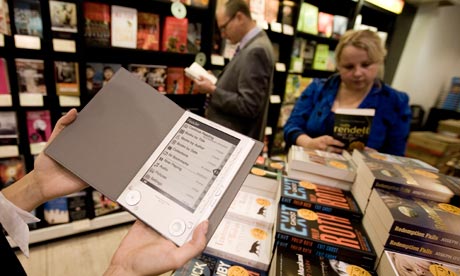

The EU is having a vote in Brussels this week that might have a reverberating effect on the taxing of eBooks. The UK has no VAT fee when it comes to buying paperbacks or hardcovers but eBooks are subject to a 20% VAT fee. This has prompted companies like Kobo and Amazon to operate in Luxembourg where the VAT is only 3%. The new vote could feasibility eliminate the VAT on digital books and put them on par with the ones found in bookstores.

Experts said abolishing the rate could cut the price of an eBook by £1 or more if booksellers such as WH Smith and Amazon pass on the savings. Books are considered to be an essential contribution to society and the booksellers industry say there is no distinction between the tangible and intangible.

‘Most of the EU countries are frustrated by the VAT differences on eBooks. The Polish presidency could end up delivering UK readers a real boost whilst levelling the playing field for the region’s digital industries,’ said Richard Asquith, head of tax at business adviser TMF Group.

The goal with this vote is to harmonize the VAT rate on eBooks across the entire EU. Many different countries already charge their own VAT rate for digital books, France is at 5%, Luxembourg at 3% at the UK at 20%.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.