Over the course of the last five years, e-commerce giant Amazon has definitively captured the vast majority of the ebook market. When Apple decided to launch its iBooks digital storefront in 2010, the company needed an edge to be competitive. Steve Jobs met with executives from Hachette, Macmillan, Penguin, Harper Collins, Random House, and Simon and Shuster. They ironed out a scheme that would level the playing field and establish ebook pricing that all resellers had to abide by. This allowed Apple to gain traction with its new digital bookstore and allowed smaller retailers to offer the same pricing as Amazon. The US Justice Department took exception to this collusion and a lengthy court battle has ensued. One by one, every single publisher has settled out of court and only Apple remains in a proxy battle against Amazon.

Amazon has long controlled the ebook market and stiffed competitors by offering electronic books cheaper than the competition. The company would buy digital books in bulk and sell it below cost, which ruffled the feathers of all the major publishers. The public started to ask “Why should I pay $30 for a hardcover, when I can buy the ebook for $9.99?”

What new company on the market could afford to sell books at a loss, in order to compete against Amazon? There is no way a small start-up could have the deep pockets to buy enough ebooks in bulk and not go out of business. Apple is playing the hero, saying it has no intention with settling with the court and reserves the rights to conduct its business the way it sees fit.

The EU and US Justice Department both stated that the agency model as a whole is not the problem, it’s how the process was established. Joaquín Almunia, Vice-President in charge of competition policy at the European Commission, said “While each separate publisher and each retailer of ebooks are free to choose the type of business relationship they prefer, any form of collusion to restrict or eliminate competition is simply unacceptable.” You can think of what Apple did as establishing a “price fixing cartel,” which is illegal in the EU and mostly in the US, too.

In 2013, the Agency pricing model is all but dead. The vast majority of the big six publishers have all re-negotiated contracts with Amazon, Barnes and Noble, Apple and Kobo. eBooks can be discounted once again by 15% of the cover price, but you won’t see the large gulf in prices as before. This is partly because the entire digital industry has really grown up in a short period of time. The entire global industry was said to have garnered over $854 million dollars in 2012, and many publishers now see 21% of their revenue stem from online books.

Do you know the real reason the agency model was implemented in the first place? Sure, Apple played a small role in putting all the major players in one room, but all of those companies were not doing it to help Apple or stop Amazon. The real reason, that no one talks about, is that drastically slashed ebooks were destroying public perception of the cost of digital vs. the cost of print.

The major publishers had all agreed that if the public perception was that ebooks were dramatically cheaper than their printed counterparts, then people wouldn’t buy them. Establishing a common ground for digital pricing meant that they could control the pricing for both the tangible and intangible and make sure the physical bookstore would continue to survive. Regrettably, this decision came too late to save the stores they were trying to protect.

The Death of the Modern Bookstore

Borders bookstore started its first location forty years ago in Ann Arbor, Michigan. The world of book selling and publishing was a very different place, and is a case study on what the entire industry was doing wrong. In the 1990’s, the chain was facing declining revenues and decided to spice things up by selling CD’s. This was around the same time the Apple iPod first came out and customers were gravitating towards the digital space. Borders was stuck with storefronts that were expanded to sell media that was not profitable and put a hefty financial burden on the company.

Borders heard about the whole ebook revolution that was occurring and decided to get in bed with Amazon to turn its fortunes around. When you visited the Borders eBook page you were re-directed to the Kindle Bookstore. This encouraged people to buy all of their content from Amazon, Borders would not really see any cumulative digital revenue from digital purchases. Next, they turned to Kobo, who was all to happy to give Borders commission for every digital copy sold. This put Kobo in bed with Borders and the two sides signed off on an exclusive distribution agreement for the US.

By 2011, Borders was on the verge of collapse and its attempts to turn its prospects around were futile. The company ended up filing for bankruptcy in late 2011, shuttering 300 stores and putting 11,000 employees out of work. The main contributing factors that destroyed the company were not developing its own e-reader (like rival Barnes and Noble did), and not developing its own ebook ecosystem. Borders instead relied on selling low-margin hardware and made next to nothing on ebook sales. The day Borders assets were auctioned off, news broke that ebooks have outsold print for the first time.

When Borders was going through liquidation, the exclusive contract it established with Kobo hung in limbo for almost a year and a half. This was the main reason the USA market never really opened up for the company. It simply could not legally do business with any other major retailers to put the Kobo WIFI and Kobo Vox on the shelves. This was the only confirmed occurrence of a bookstore going under and taking a digital company along with it.

The United States is not the only market that has felt the effects of the burgeoning ebook industry. All around the world, major bookstore chains have been going out of business. Whitcoulls, Angus & Robertson, and parent company REDgroup all closed up shop in 2011. Senator Sherry in Australia said at the time, “the dramatic growth of internet book sales had reached a tipping point that would soon leave just a few specialty bookstores operating in capital cities.” She also predicted that “Bookshops will be wiped off the map inside five years.”

Europe Largely Immune to eBooks Cannibalizing Tangible Book Sales

As much as people talk about the “death of the bookstore,” the problem is mainly contained to North America, Australia, and New Zealand.

In France, there are only 1.4 million tablets being used and most are used to consume media and not read books. The e-reader population is generally paltry with only 145,000 registered devices. Kindle and Kobo currently dominate the landscape and it is much easier to procure the Kobo Touch, which is distributed by Fnac. In 2010, e-readers never really gained much traction due to an influx of substandard ones from Cool-ER, Bookeen, and Cybook. Major publishers such as Hachette have claimed that only 2% of their digital sales stem from France. Bookstores, such as Fnac, Gibert Joseph, and Flammarion, do quite well and have over 400 stores combined.

The German market is facing a lot of the same issues as France. e-Reader and digital publishing companies are finding it hard to get one of the largest markets in Europe to adopt ebooks. This is not from a lack of trying, both tablets and e-readers first hit Germany in 2009, but they have remained a fringe niche. The biggest challenge is that 78% of the population claim not to want to read from a screen, while 85% say they love printed books too much. The entire country has a very established publishing industry, and the second largest book market in the world. It was estimated that in 2011 that the entire book industry was worth 9.73bn Euros. Chains like Thalia, Verlagsgruppe Weltbild, and Hugendubel account for over 700 physical stores.

Spain is seeing a wider adoption of digital publishing and over 75% of all publishers are employing an ebook strategy. There are an estimated one million tablets and e-readers currently being used in Spain, with over 285k e-readers sold in 2011. Libranda is one of the largest ebook distribution platforms that was founded by the big three publishers in Spain: Grupo Planeta, Random House Mondadori, and Santillana. One of the largest concerns in Spain right now is the price of ebooks in general. If you look at the VAT prices on printed books it currently sits at 4% while ebooks are much more expensive at 17%. The high taxes have been a large barrier in mainstream adoption of digital content. The entire Spanish bookstore scene is as vibrant as ever.

The ebook market was worth about 18m Euro in 2010 (0.6% of the industry), with no more than 90,000 ebooks in various formats – many PDFs included. Max 8% of printed books are available as ebooks, though many of the main European publishers have built content distribution platforms like Numilog (Hachette), ePlatforme (Editis), and Eden (Gallimard/Flammarion/La Martiniere).

The United Kingdom is one of the only European countries to see a profound change in the bookstore landscape because of digital sales. The main victims are small and medium sized stores, while the chains continue to do well. There are only 2,178 high street bookshops in Britain as of July 2011. Back in 2005 there were 4,000, and this has left almost 580 towns without a single bookstore. There were two major contributing factors, one was the shift to digital and the other was super market chains getting into the book business.

The major bookstore chains, such as Waterstone’s, Blackwell’s, WH Smith, and Foyles have largely been immune to the e-reader and ebook revolution. All of these companies started offering e-readers and ebooks when they first started getting popular in 2009. In recent years all of these shops have inked deals with Kobo, Amazon, and Barnes and Noble to sell devices and get a cut out of each digital sale. This has allowed continued digital revenue to be generated, rather then just the initial sale of the hardware.

Nielsen BookScan shows physical book sales in the UK have declined every year since hitting a peak of £1.8bn in 2007 – the year the final Harry Potter installment landed in bookshops. In the first 10 months of 2012, printed book sales were down 3.5% year on year in volume terms and 5.5% by value. Overall digital sales of general consumer titles increased from £30m to £84m between January-June 2011 and 2012. These increases reflect overall growth of 89.1% in digital sales (from £77m to £145m.)

Agency Is Dead, Now What?

There is no denying that ebook sales in most developed countries are consistently rising and some markets are enjoying robust sales. Now that major online retailers can once again establish discounts on new and backlist titles, bookstores will have to struggle even more. It is very hard for a mom and pop shop to have to sell a book at the listed cover price, while a competitor lists it online for 1/3 of the cost. Still, indie bookstores do have alternatives than just offering price.

The American Booksellers Association and UK Booksellers Association have all inked deals with Google, which never really worked out. In 2012, they started to do business with Rakuten owned Kobo. The essence of this program is that it allows small shop owners to sell e-readers, ebooks, and have access to marketing materials. Small bookstores have seen a rise in business with the sale of hardware and the commutative digital commissions they receive when a customer purchases a digital book.

If indie stores belong to each booksellers association, they can opt into this new program and it is in Kobo’s best interest to keep the bookstores alive, whether small or large. The company has quickly grown in market stature, partly due to all of the agreements they made with stores all over the world. Kobo’s success has been partnering with as many bookseller associations and getting hardware into as many stores as possible. This is the only company that has a vested interest in the survival of the bookstores, if they sink, so does Kobo.

Small stores all over Canada, US, and the UK are going out of business. You would be hard-pressed to go a few weeks, without one closing in your town. The trend I have noticed is all the stores that close resisted digital to their dying breath, or just wonder where all the people have gone. Small and medium sized bookstores HAVE to embrace digital if they hope to survive at all.

Wrap Up

Digital Retailers are seeing record levels of business! Kobo reported 4 million new customers within the last six months to bring its total to more than 12 million. On the worldwide stage, Kobo now controls around 20% of the entire e-reader market and is poised to continue its accelerated growth patterns in 2013. Amazon sold $383 million worth of ebooks in 2012 and controls 45% of the global market. Barnes and Noble is thought to control 25% of the US market and generated over 3 billion dollars with Nook hardware and ebooks in 2012. B&N announced yesterday that the store sales were down 10% in the December quarter from the same quarter a year ago—driven in part by an 8.2% drop in store sales—and the company plans to shutter 30% of its retail stores in the next decade.

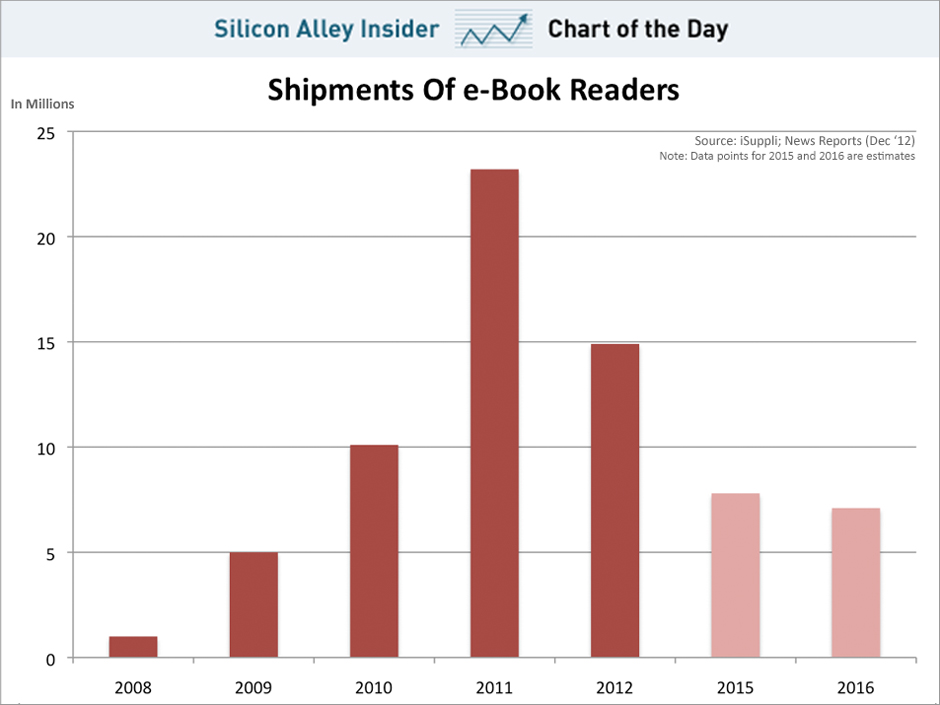

Industry Specialists agree that e-reader sales are on the downward trend, as the public is gravitating towards tablets. Research firm iSupply notes that e-reader sales hit their peak and are being outpaced by iOS and Android powered tablets. The hardware is changing from dedicated e-ink readers to multipurpose tablets. Aside from the shift in technology, the one consistent fact is that ebooks, digital magazines, and digital newspapers are seeing increasing profits, and will continue to do so.

There is no denying that the agency model is dead and online resellers can price war with each other in a bid for your digital dollars. The brick and motor stores in the US, Australia, UK, and New Zealand are all seeing declining print sales across the board. The bookstore, as we know it, is on the ropes and will see a dramatic scaling back in new stores opening. People are gravitating towards digital and the abolishment of the agency model effectively put another nail in the coffin.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.