In a brief statement, Indigo reported that it has received a buyout proposal in early February from Trilogy Retail Holdings Inc. and Trilogy Investments L.P. to acquire all of the common shares of Indigo that Trilogy does not already own.

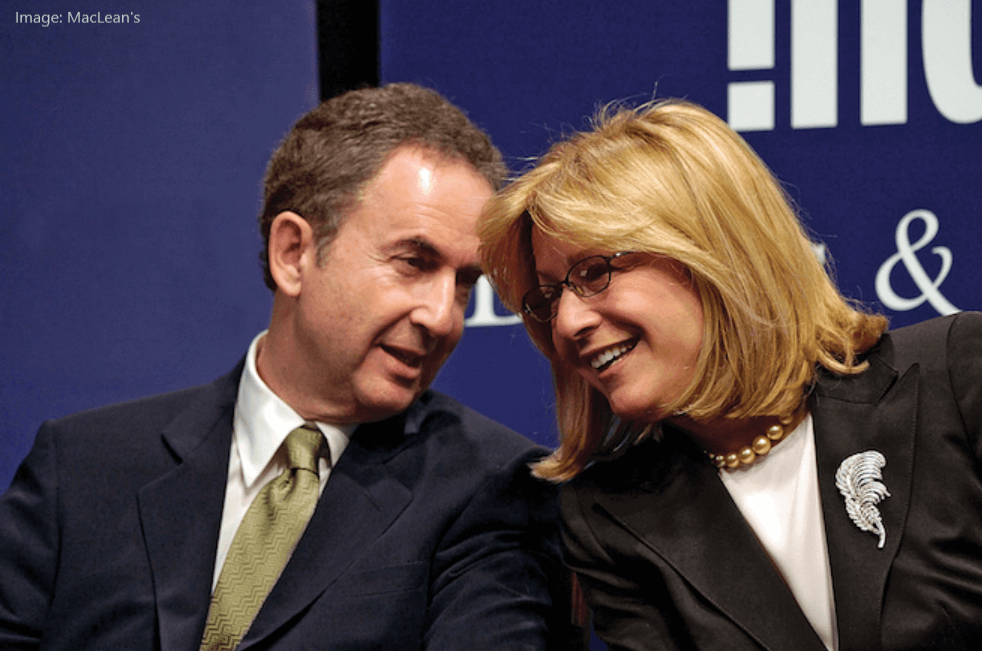

The two Trilogy firms are personal holding companies of Gerald Schwartz. Schwartz is already a company insider as he sits on Indigo’s board of directors. In addition, he is the husband of current Indigo chief executive, Heather Reisman.

The idea behind this buyout is that it would allow Indigo, which has had considerable challenges over the last year, to get back on track easier as a private corporation, than if it remained public. Over the past year, the company has dealt with cyber attacks, board member turnover and large financial loss. As such, this fall, the company announced putting into place a “strategic plan”, which involved Heather Reisman coming out of retirement. It also saw the company letting go of employees, as well as downsizing.

In an interview last Friday, Reisman said, “We made the decision to rightsize and rightshape our general merchandise inventory. This strategic decision to clear unnecessary inventory had a significant impact on margins and therefore profitability, but it was the right decision.”

By going private, the company can continue moving forward with more flexibility, as it will not have to deal with public shareholder pressure and corporate governance. Richard Leblanc, a professor of law and ethics at York University in Toronto, shared with The Financial Post, “I think the rationale is not to be saddled with public reporting responsibilities because Indigo has been through a lot.”

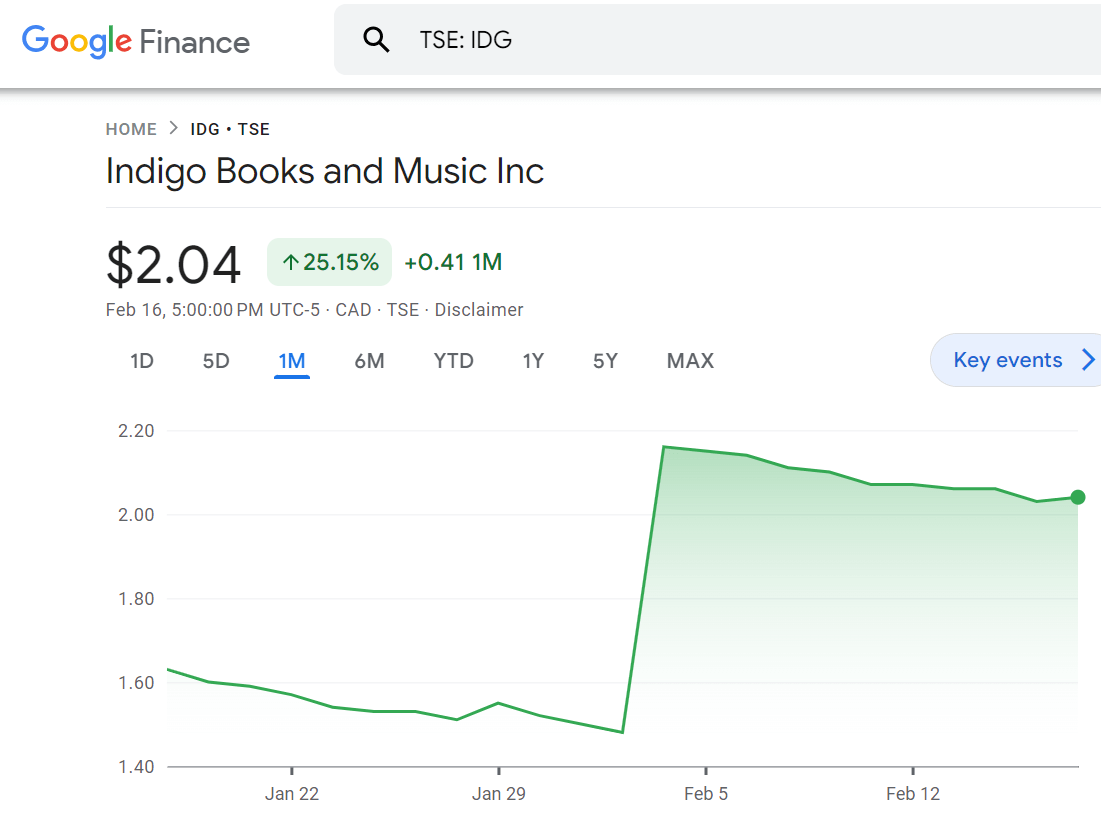

The buyout offer from Trilogy was for C$2.25 in cash per share. As reported by Yahoo Finance, “The Board cautions shareholders and others considering trading in securities of the Company that it has only received the Proposal, and no decisions have been made by the Board or the Special Committee with respect to the Company’s response to the Proposal or the transaction contemplated by the Proposal.”

However generous the offer, it’s worth noting that it’s basically the same people in the scenario. Kai Li, the Canada Research Chair in corporate governance University of British Columbia Professor, shared with The Financial Post, “The offer is very generous, but it’s basically the same people on the offer side and also on the receiving side.” As such, a possible downside to this could be a lack of new ideas and fresh blood at the table.

In general, privatization, involves a financial transaction which converts a public company into a private one. As shared by BDO, the process typically entails:

- The transfer of a public company’s voting or equity securities from the hands of public shareholders to the hands of one or few shareholders

- A delisting of the company’s securities on a public market

- The company ceasing to be a “reporting issuer” (as defined in the applicable provincial securities laws) in Canada

As reported by BNNBloomburg, shares of Indigo Books & Music shot up more than 50% since the privatization proposal was announced.

An avid book reader and proud library card holder, Angela is new to the world of e-Readers. She has a background in education, emergency response, fitness, loves to be in nature, traveling and exploring. With an honours science degree in anthropology, Angela also studied writing after graduation. She has contributed work to The London Free Press, The Gazette, The Londoner, Best Version Media, Lifeliner, and Citymedia.ca.