Amazon has been involved in the tablet sector since 2011 and their success has driven B&N from developing their own hardware and totally pushed Kobo out of the market. In 2015 Amazon released the $50 Fire tablet and it was significantly lower than the average vendor selling price of $323. I can safely say that the $50 Fire has disrupted the entire tablet market.

Jeff Orr, Research Director at ABI Research stated “Unlike other tablet manufacturers, Amazon views hardware as a commodity and emphasizes focus on its recurring digital content revenue stream, generated from selling digital books, music, TV, and video programming to owners of its devices. The incredibly low pricing of the Fire Tablet is a smart and strategic move, as few others can afford to accept a lower margin on their tablet devices in favor of driving a surplus of content-related revenues.”

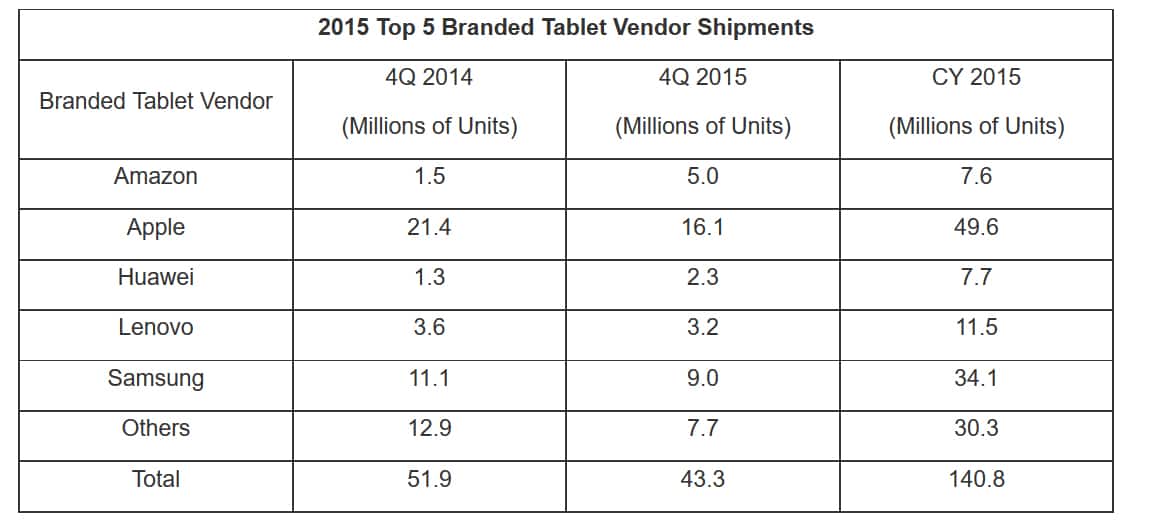

ABI Research estimates that the company sold five million of its various tablet models during the final three months of 2015. At this figure, Amazon ranks #3 overall for branded tablet shipments for that quarter and #5 for the full 2015 calendar year.

“Most tablet vendors continue to take a wait-and-see approach to Amazon’s Fire Tablet release,” continues Orr. “It’s a path only few can follow, as vendors without content distribution rights and value-added services can only rely on the transaction price of their hardware to stay in business. For instance, LeEco, formerly LeTV, in China is attempting a similar model. Conversely, content owners may find value in broadening their ecosystems by striking relationships with tablet vendors to get their programming in front of more users.”

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.