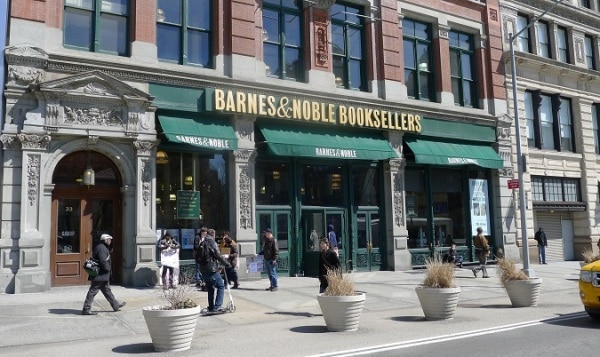

Barnes and Noble announced their latest financial results on Thursday and their stock rallied 7.85% due to smaller-than-expected quarterly loss. The bookseller reported that total sales were $821 million for the quarter and $3.9 billion for the full year, decreasing 6.3% and 6.5% over the prior year periods, respectively. Comparable store sales declined 6.3% for both the fourth quarter and full year. Online sales increased 2.9% for the quarter and 3.7% for the full year.

There are murmurings in the bookselling world that due to Amazon purchasing Whole Foods for a strong retail presence, Barnes and Noble might be a takeover target. B&N operates 640 retail locations and over 200 of them have their leases expiring this year. The company has stated they plan on remodeling a large number of them.

Key Points

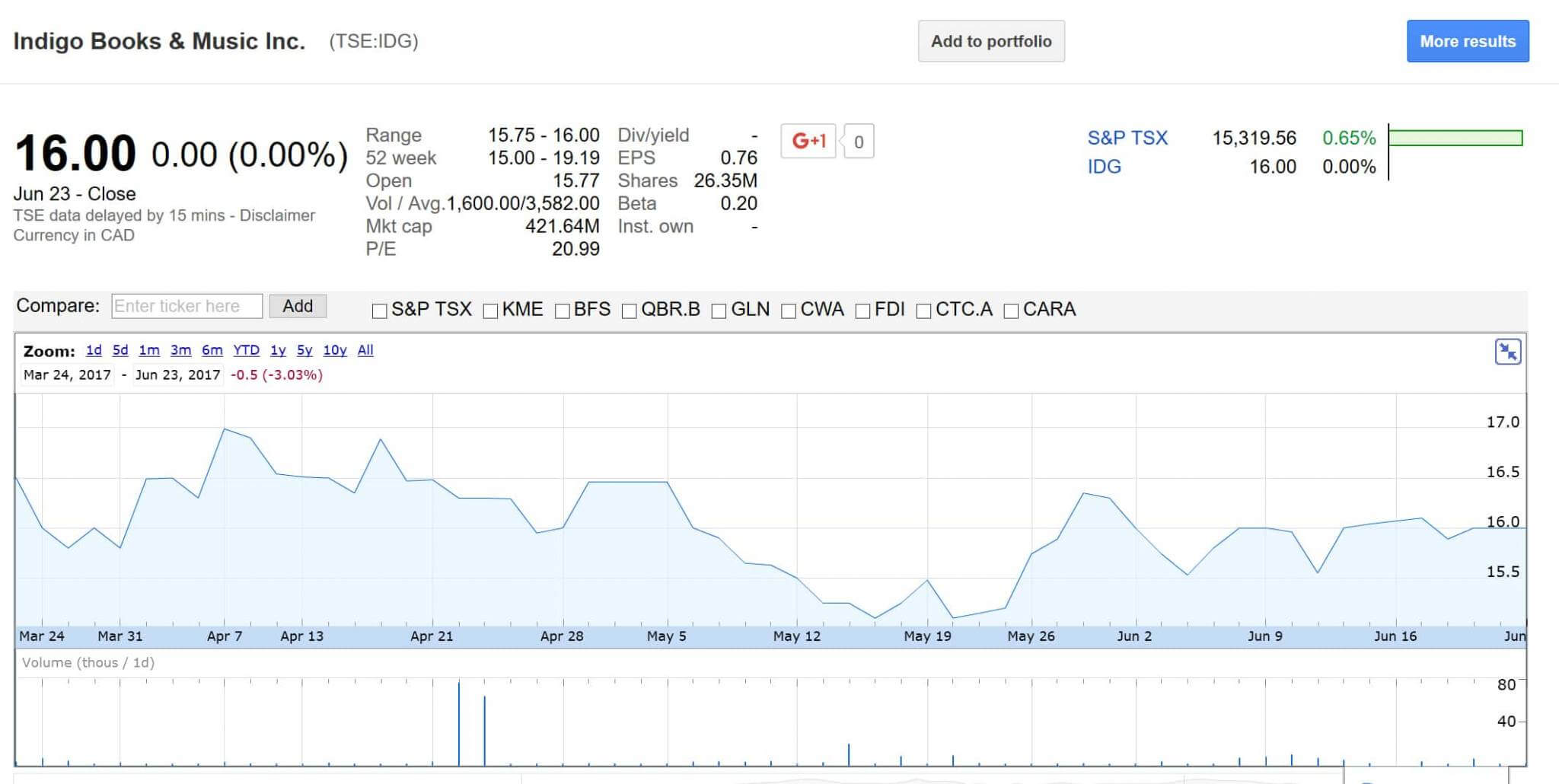

- BKS says comparable store sales fell 6.3% for both Q4 and the full year, but online sales rose 2.9% for the quarter and 3.7% for the full year.

- BKS says FY 2017 was a challenging year but it reduced costs by $137M, “enabling us to sustain our profitability level” – shares have dropped 42% YTD.

- For FY 2018, BKS expects comparable bookstore sales to decline in the low single digits with full year consolidated EBITDA of ~$180M.

Michael Kozlowski is the editor-in-chief at Good e-Reader and has written about audiobooks and e-readers for the past fifteen years. Newspapers and websites such as the CBC, CNET, Engadget, Huffington Post and the New York Times have picked up his articles. He Lives in Vancouver, British Columbia, Canada.