Digital publishing is seeing a sharp upward trajectory in Vietnam, the publication Vietnamnet reported. It was on March 22nd that luminaries from the publishing realm convened to reflect on the year that was 2023 and to introspect as to what lies ahead in 2024. What emerged from this conference, hosted by the Authority of Publication, Printing, and Distribution under the … [Read more...] about Digital publishing witnessing sharp growth in Vietnam

Digital Publishing News

eBook revenues were up in 2023 and generated $1.0 billion

Digital book revenues in the United States were up 0.6% in 2023, generating $1.0 billion. Digital audiobooks are the fastest-growing segment in digital publishing, and sales were up 14.9%, reaching $864.0 million in revenue. Physical Audio was down 16.2%, coming in at $12.9 million; this shows that digital audiobooks are killing off the tape and CD market.Trade revenues … [Read more...] about eBook revenues were up in 2023 and generated $1.0 billion

Al Pacino to Publish Memoir

AI Pacino (Alfredo James Pacino), the legendary American actor is set to release his memoir Sonny Boy in October this year. The actor’s highly anticipated new book will be published by Penguin Press.The memoir will cover the 83-year-old Oscar-winning actor’s childhood in New York and his upbringing by his mentally unwell mother. It also talks about Pacino’s young friends in … [Read more...] about Al Pacino to Publish Memoir

Book Publishing in Modern Times

Traditionally, authors would pass through judgements in the publishing world for getting their books published and distributed. In old times, it was a challenge for authors to market or produce their books without the help of a book publisher.But things have changed now in modern times. The growth of the internet and marketing digitalization, authors can now overcome many … [Read more...] about Book Publishing in Modern Times

Why Print Books Have Blank Pages

You must have noticed blank pages in both paperback and hardcover books. But have wondered what is the purpose of these blank pages? On top of that, why don’t ebooks have blank pages like that?Well, blank pages in print books can be intentional, for example, for allowing authors to sign or for readers to make notes. Intentional empty pages In hardcover books, the first … [Read more...] about Why Print Books Have Blank Pages

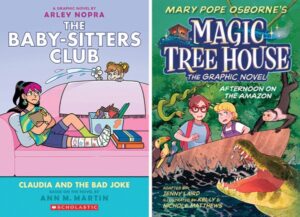

Boom in Graphic Adaptation of Middle Grade Books

Image credit: Publishers Weekly Middle grade graphic novel category is becoming popular in recent years. As a result, the number of graphic adaptations of middle grade books has also exploded. That’s because graphic adaptations bring older stories to life and expand the audience. In fact, such graphic novels have gained acceptance among educators, parents, and librarians also. … [Read more...] about Boom in Graphic Adaptation of Middle Grade Books

Inkitt AI Self-Publishing Platform Nabs $37M

Image credit: Inkitt Inkitt is a brand-new self-publishing platform that allows people self-publish stories. Then, it uses AI and data science to select the most compelling stories. Finally, it tweaks, distributes and sells those stories on a second app Galatea.Now, it’s raised $37 million in aid of that ambition. The startup has already attracted 33 million users … [Read more...] about Inkitt AI Self-Publishing Platform Nabs $37M

200+ Million Digital Piracy Instances Removed in 2023

Piracy is a major issue for digital publishers including Kakao Entertainment's subsidiary Tapas Entertainment, which focuses on publishing webcomics and web novels. For publishers that make their money off of clicks and microtransaction coins, having the same content being uploaded elsewhere for free on the same day without the owners' permission can have long-term consequences … [Read more...] about 200+ Million Digital Piracy Instances Removed in 2023

Tell us what you think: Survey on A.I. Training

The rapid progression of Artificial Intelligence has led to new and unprecedented circumstances for societies around the world. Generative technologies have been thrust into multiple sectors of life; business, law, education, content creation, writing and journalism- to name a few.As such, we are now faced with complex legal and moral issues surrounding AI's ingestion of … [Read more...] about Tell us what you think: Survey on A.I. Training

Pocket FM launches Pocket Novel

Pocket FM is to launch of Pocket Novel to build it as India’s largest online reading platform and the default destination for the Indian writers’ community. The audio series platform also announces an investment of US$40 million to solidify its presence in the literary world.With this launch, Pocket Novel is intended to play a key role in unlocking opportunities and … [Read more...] about Pocket FM launches Pocket Novel

Book Publishing in Sri Lanka Faces Crisis

The imposition of VAT (18%) on books publishers in Sri Lanka results in the loss of thousands of jobs. Publishers say that about 30 percent of bookstores have shut down because of the country’s economic crisis.Before January 2024, there has been no taxes no books, and Sri Lanka’s book publishing industry was in crisis even before the VAT imposition. The cost of book … [Read more...] about Book Publishing in Sri Lanka Faces Crisis

MindStir Media: Pioneering Self-Publishing in the USA

MindStir Media is the leading provider of self-publishing and book marketing services in the United States. Bestselling author and award-winning entrepreneur J.J. Hebert founded the organization. The platform is intended to give authors all the necessary tools to share their work with the world. This year, MindStir Media has celebrated its 15th anniversary.J.J. Hebert … [Read more...] about MindStir Media: Pioneering Self-Publishing in the USA

eBook revenues were down 3.2% in November 2023

In one month, we will understand precisely how digital audiobooks and ebooks performed in the United States in 2023. Digital book revenues were down 3.2%, generating $81.8 million in sales. The Digital Audio format remained 15.3% for November, generating $81.1 million in revenue. Physical Audio was down 23.8%, coming in at $1.3 million. Year-to-date eBook revenues were down … [Read more...] about eBook revenues were down 3.2% in November 2023

European Publishers To Get AI Act Approved

Image credit: edf-feph.org The European Union’s “AI Act” was approved in December. The AI act is a part of EU’s digital strategy and is meant to regulate the AI usage to ensure better use of the technology.Recently, the Federation of European Publishers in Brussels has released a statement on behalf of creators and rights holders, calling on “member-states of the European … [Read more...] about European Publishers To Get AI Act Approved

IOP Publishing to Create Purpose-Led Publishing (PLP)

Image credit: The Bookseller As reported by The Bookseller, IOP Publishing has joined forces with AIP Publishing and the American Physical Society to create Purpose-Led Publishing (PLP), a new coalition “with a promise to always put purpose above profit”.IOP Publishing provides publications, including journals, websites, magazines and books, through which scientific … [Read more...] about IOP Publishing to Create Purpose-Led Publishing (PLP)

ebook piracy is considered a minor problem by US government

Digital book piracy is considered a very minor problem by the United States government. The Office of the United States Trade Representative has just published its annual overview of the world's most significant and problematic piracy websites. The vast majority of the sites focus on file hosting websites, streaming IPTV boxes and pirating websites. Over 25 different sites, in … [Read more...] about ebook piracy is considered a minor problem by US government